Creating Invoice cum Bill of Supply in

JioGST Bill Lite

To create Invoice cum Bill of Supply

tap on 'Documents' tab in the Home page and select 'Generate Document' option

You will be taken to the Generate

Document screen. On this page fill the below mentioned details:

1. Document type:

Select the type of document you want to create from

the drop-down. Using JioGST Bill Lite you can create Invoices, Bill of Supply

& Invoice cum Bill of Supply.

For creating Invoice cum Bill of Supply select

'Invoice cum Bill of Supply' option.

2. Select GSTIN:

Select GSTIN from the drop down against which you

want to create the Invoice. Dropdown will have the list of all the added

GSTIN's from your account.

3. Document date:

Select the date against which you want to create

the Invoice cum Bill of Supply from the calendar.

4. Document for:

In JioGST Bill Lite, Invoice cum Bill of

Supply can be created for Goods/Services. Select one of the option.

5. Goods/Services sold through Ecommerce

operator:

If the goods/services are sold through e-commerce

operator select this option. You will also have to enter the GSTIN of the

E-commerce operator.

6. Reverse Charge applicable:

If the document attracts reverse charge select this

option.

7. Document Period:

If the Invoice cum Bill of Supply is created

for Services than you need to fill the time period for which the service was

delivered. If it is for Goods, you wont see this option.

8. Customer Name/ Mobile No.

Enter the first few alphabets/digits of the

Name/Mobile No. of the customer against which you want to create this Invoice

cum Bill of Supply.

Please ensure you have added Customer in the

customer master. If no customer is added in the customer master you will first

have to add a customer and then create Invoice cum Bill of Supply.

To add a customer in the Customer Master read blog:

9. Make Shipping Address same as

Billing address

By default this option will be checked, in case

your Shipping address is not same as Billing Address uncheck the check box.

A list of the below mentioned fields will appear on

screen:

- Ship to Customer Name: Enter

the name of the customer to whom the Goods/Services will be shipped

- Ship to Address: Enter

the address where the Goods/Services needs to be shipped

- Ship to Pin code: Enter

the Pin-code for the above mentioned address

- Ship to City, Place of Supply: Both

these fields will be auto-populated based on the entered pin-code in the

above field

10. Bill Method:

Select the Billing method from the drop-down.

Billing method can be either 'Quantity based' or 'Lump sum'

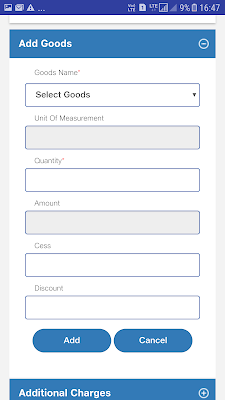

11. Add Goods:

Tap on the add icon/Add Goods. The below mentioned

fields will appear on screen.

To create Invoice cum Bill of Supply for

Goods/Services, atleast one Good/Service must be added in the Goods/Service

master catalogue.

To add Goods in the Goods Catalogue master read

blog:

https://jiogstbilllite.blogspot.com/2018/03/goods-Master-jioGST-Bill-Lite-HSN-SAC-code-UOM-tax-rate.html

To add Services in the Services catalogue master

read blog:

https://jiogstbilllite.blogspot.com/2018/03/Services-Master-jioGST-Bill-Lite-HSN-SAC-code-UOM-tax-rate.html

- Goods Name: Select the Goods form the

drop-down. You will get the list of all the added Goods from the Goods

master here.

- Unit of Measurement: This will

be auto-populated form the Goods Master based on the Goods you select.

- Quantity: Enter the quantity you want to sell for

the selected goods.

- Amount: This field will be

auto-calculated based on the values you provide in the above 'Quantity'

field and the 'Goods rate' mentioned in the Goods master for this

good/product

- Cess: Enter the cess against this

product

- Discount: Discount provided if any

against this product can be entered in this field.

After filling the above details tap on 'Add'

button. The added good will be seen on screen, you can also Edit or Delete this

Good by clicking on respective icons besides it.

For adding Multiple Goods within this Invoice cum

Bill of Supply tap on 'Add' button.

12. Additional Charges:

Additional charges if any can be included against

this Invoice cum Bill of Supply by tapping on Additional Charges or the

add icon.

Select the additonal charge from the drop down. A

list of all the added additional charges from the Additional Charges master

will be displayed.

If no additional charge is added in the master than

you will first have to add one in the Additional Charge Master.

To add additional Charges in the Additional Charge

master read this post:

Amount will be auto-populated from the master. You

can even edit the amount value.

Once the above details are filled, tap on Add

button. You can also add multiple additional charges in a single Invoice cum

Bill of Supply. All the added additional charges will appear on screen.

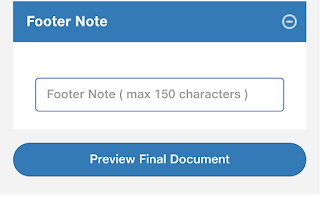

13. Footer Note:

Footer Note is field where you can mention other

details like Bank Account Number, Mobile No for your customers.

Once all the above details are filled, you can tap

on 'Preview Final Invoice cum Bill of Supply' button to preview it before

creation.

You will be taken to the 'Preview' screen.

On this page the final Invoice cum Bill of Supply

will be displayed. All the tax rates and calculation will be done

automatically.

Once verified you can create the Invoice cum Bill

of Supply by tapping on 'Send Invoice cum Bill of Supply' button at the

bottom of the page. In case you want to make some changes tap on 'Edit' button

A pop-up of Terms & Conditions would appear on screen. On

tapping 'Send Bill of Supply' it will be created and an email with the pdf of

Invoice cum Bill of Supply will be sent to the customer as well as to your

email id.

You will now see a pop-up displaying the Invoice

cum Bill of Supply Id.

The Invoice cum Bill of

Supply has been created successfully. Click on 'OK' button

You can check the Invoice cum Bill of

Supply you just created in the 'Document History' option under 'Documents

Management' tab.

Document Number of all the Invoices/Bill of

Supply/Invoice cum Bill of Supply generated will be displayed on this screen.

How to Download JioGST Bill Lite?

Bill Lite is a software product built

by JioGST